Card Transaction Process

I sat down recently with a renowned journalist who wanted to learn more about credit card transaction processing. We discussed the steps involved in every card payment, the parties who facilitate transactions and a 30,000-foot view of the economics involved.

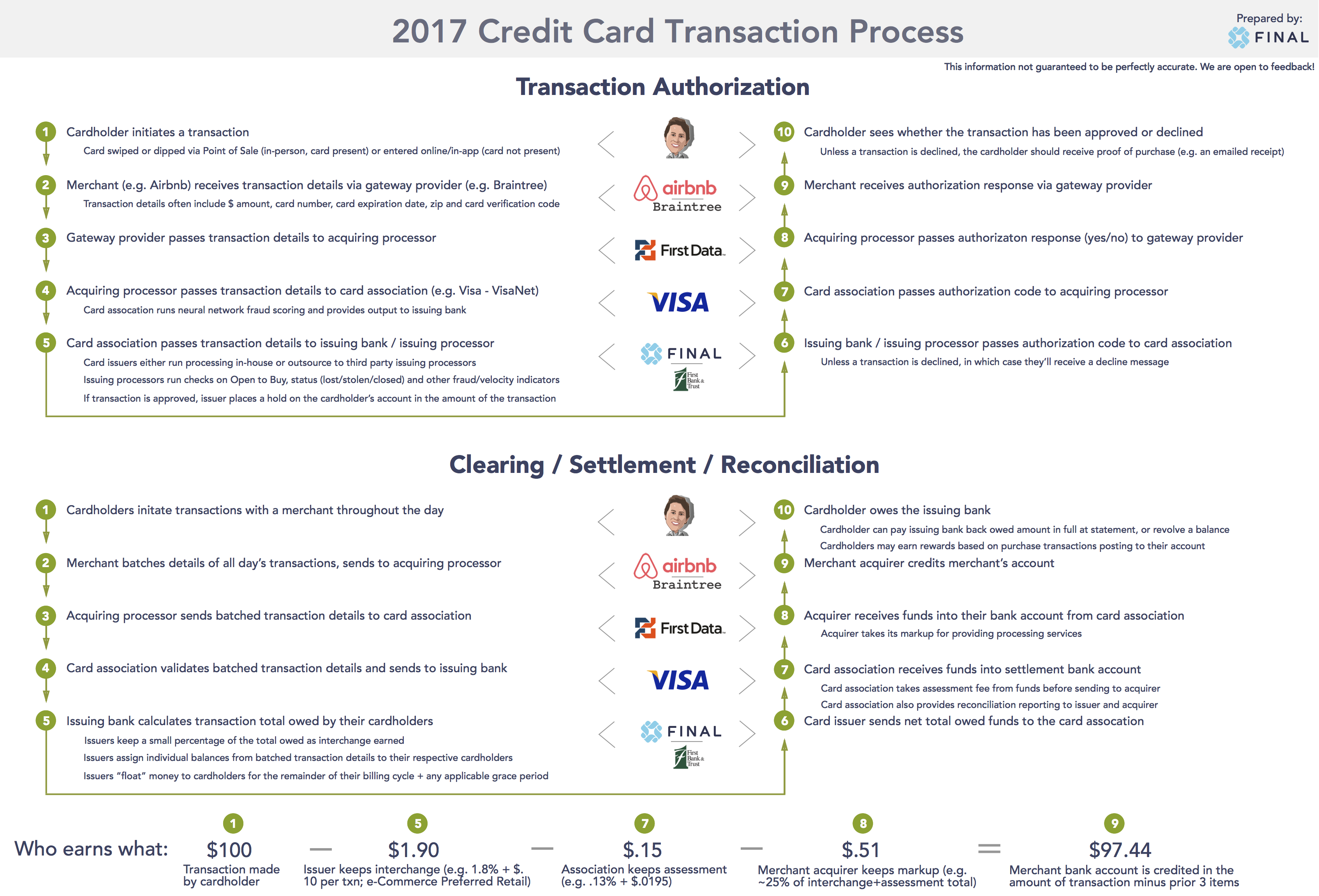

The “magic” of presenting your card to the merchant and getting an approval for a completed transaction has a surprising number of steps and parties involved…

In thinking more about that conversation, and searching around for a recent resource that clearly laid out the specifics of the topic, it seemed like there was no great single source that displayed the complete flow.

So, for anyone who is interested, and to fulfill a promise made to said journalist, I’ve put together a detailed view into the card transaction flow, including definitions to aid understanding.

Diagram 1 below shows the two major parts of a credit card transaction: the “authorization” and the “settlement.” Diagram 2 provides important industry definitions of terms used in Diagram 1.

Authorization, in its simplest form, is the process by which a merchant gains permission from the card’s issuer to charge the card. Settlement, in its simplest form, is the process by which a merchant is paid for the goods or services sold, by the issuer (on behalf of their cardholder).

Note that at the bottom of this diagram, we provide a view into the rough economics of an example $100 credit card transaction, along with accompanying numbers tying steps in the settlement process to the dollar figures represented.

Let’s take a look at that diagram now.

We hope that between these resources, we’ve helped fill gaps in reading materials. Feel free to send any questions to processing@getfinal.com. Thanks for reading :)